Arizona Mortgage Broker

Ex-Arizona Mortgage Broker Exposes

the Mortgage Industry’s Dirtiest Secrets

and Reveals How to Avoid Being Ripped Off

(A letter from the author of ArizonaMortgageBroker.org, Brett Nordin)

Dear Reader,

You may be wondering why I developed this website if I’m no longer in the mortgage or loan industry.

Before I became an Arizona mortgage broker, and ultimately the branch manager for a national mortgage company, I was the victim of a loan shark.

Was I the perfect victim? Not by definition.

- It happened on my third home purchase, not my first

- The mortgage broker was referred to me

- I was working with a realtor who was also a family member to guide me through the transaction

- I knew how the industry worked, how much to pay and had strong credit

So how did it happen to me?

The perfect storm of confidence, trust, pressure and lack of knowledge allowed me to make a bad decision. Frustrated, is probably the best way to describe how I felt. I couldn’t ask the right questions because I didn’t know what to ask. In the end, I let the momentum of the deal and fear of losing the house to another buyer force me into a mortgage that is still haunting me today.

Because of this experience I’m now on a mission to eliminate loan sharks from the mortgage industry and raise the ethical bar of mortgage professionals through consumer education. My hope is this website will help you avoid the expensive mistakes I made and ensure you get the best deal on your next mortgage.

What is a Loan Shark?

The U.S. Government calls them “predatory lenders” and has given consumers rights to protect themselves against bad lending behaviors. But did you know that lenders can charge up to 8% of the loan amount for their services without being classified as a predatory lender? If you were purchasing the average home in Arizona, you could spend over $20,000 in finance charges and have no legal recourse. You can get ripped-off, and it’s perfectly legal!

That’s where the Loan Shark swims in. Somewhere in the murky water between what is illegal and what is fair. Preying on what the average consumer doesn’t know and using the current of overflowing documents and riptide of fear to mask their approach.

Feeding behaviors of the Loan Shark:

- A Shark charges excessive fees, points and interest rates

- A Shark uses prepayment penalties and adjustable rate mortgages that increase without regards to market conditions

- A Shark uses aggressive or deceptive practices to sell their loans

- Sharks strip equity from homes and lend without considering the borrower’s ability to repay the loan

- A Shark mails or calls regarding extraordinary offers to consolidate your bills

- A Shark uses Spanish speakers to gain trust and confidence of Hispanic homebuyers

The Arizona Attorney General, Terry Goddard recently wrote:

“Deceptive lending is an all too common problem for Arizona residents…predatory lenders are ready to take your money and may end up taking your home.”

How can you avoid being the victim of a Loan Shark?

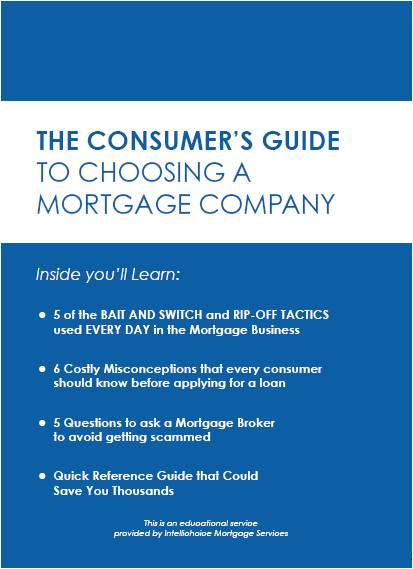

Step 1 is obtaining a free copy of the Mortgage Guide I created to educate thousands of borrowers. Even the best-educated consumer can have trouble understanding all of the numbers and loan application forms. I designed this website to serve as a quick reference that you can use during conversations with a mortgage professional. On these pages I part the curtain on the mortgage industry and arm you with the knowledge needed to avoid paying too much for your mortgage.

Please leave a comment below if you have found this website useful or with any improvements that could protect others.

Sincerely,

Brett Nordin, Ex-Arizona Mortgage Broker

P.S. ArizonaMortgageBroker.org has been designed to give consumers one-place to get critical information to make an educated decision on their mortgage refinance or new home purchase. This website contains information on Arizona mortgage loan programs, Arizona mortgage rates, Arizona mortgage calculator, a complete Sell By Owner guide and ways to fix your credit score.

If you considering a second mortgage or HELOC for home improvement such as kitchen remodeling, bathroom remodeling, window replacement or repair, new doors, hardware upgrade or new appliances, please contact us for a list of ethical lenders in your area.

We also suggest using our recommended resources after you’ve become completely informed on how to select an Arizona mortgage broker or lender.